FCFF also tells about the performance of business and investments. Indicators for Business: Business with positive FCFF indicates the sound financial health of the company, while negative FCFF indicates the company’s inability to generate higher revenues.But in FCFF, considering actual cash flows, this method is much more helpful in analysis. Earnings can be manipulated with aggressive accounting practices like a high depreciation rate. Difficult to Manipulate: Unlike other indicators like EPS(Earnings per share), Free Cash Flow to the Firm gives a much more accurate picture.

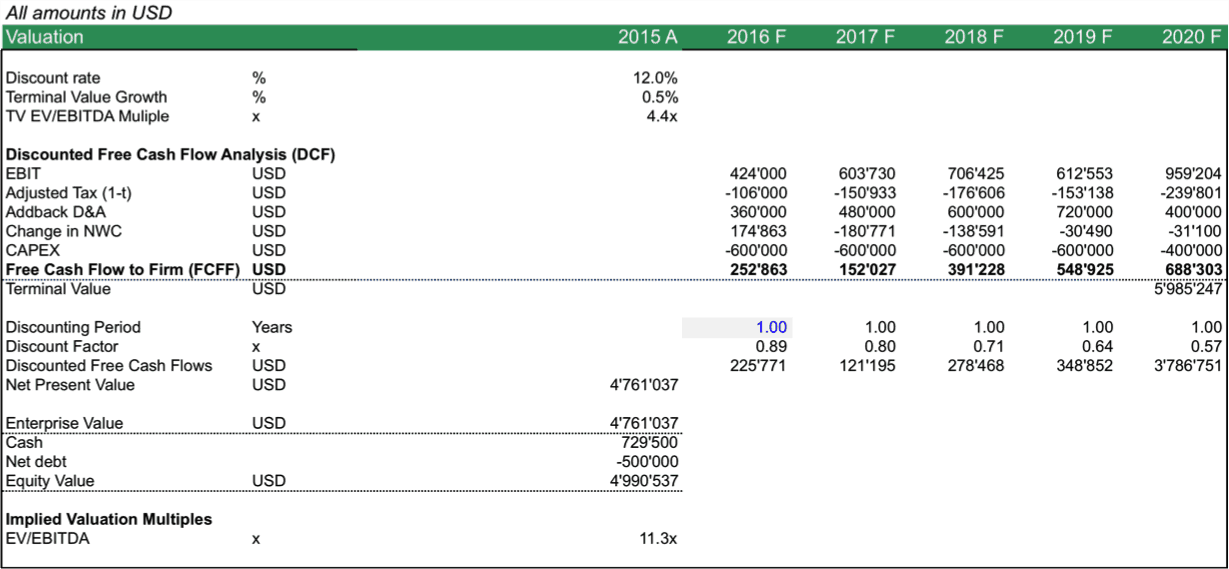

Importance and Uses of Free Cash Flow to Firm Although negative FCFF can result from the company’s increase in investment for future growth, an investor should understand and study a company’s finances before making a judgment. The negative value of FCFF indicates the company’s inability to generate enough revenue to match its operating costs and investment activities. For investors, it is helpful to understand whether such stocks are overvalued or undervalued in terms of price.Ī positive value of FCFF indicates a company can maintain cash even after expenses and investments. It is one of the most important tools in the calculation valuation of the stock. FCFF indicates the company’s growth and performance over the years. FCFF = ($595 * (1 – 30%)) + ($175 * 30%) – $200 – $45įree Cash Flow to the Firm indicates cash, which is available with the company for investors after payment of all debts, expenses, investment in current assets,s and investment in long-term assets.Now to Calculate Free Cash Flow to the Firm, we need, Selling, General, and Administrative Expenses FCFF = (EBITDA * (1 – T)) + (D&A * T) – Capital Expenditure + Changes in Net Working CapitalĮBITDA: Earnings before Interest Tax Depreciation and Amortisation Examples to Calculate Free Cash Flow to Firmįollowing are details of Company ABC Income Statement of ABC

0 kommentar(er)

0 kommentar(er)